Contributor Guide

Contributors are required to submit the appropriate tax forms to Clipcentric prior to any payments being processed. This topic describes which forms are required, and provides guidelines for completing them. US Resident Contributors United States tax law requires us to submit form 1099 for all payments to US resident contributors totalling $600.00 US or more in a calendar year. In order for us to complete this form, we require you to submit a completed IRS form W-9 to us. No payments in excess of $600 will be processed until we have received your properly completed W-9. A W-9 Form and instructions may be found here, or at http://irs.gov. Completed W-9 forms should be sent with an original signature (i.e. not a copy) to:

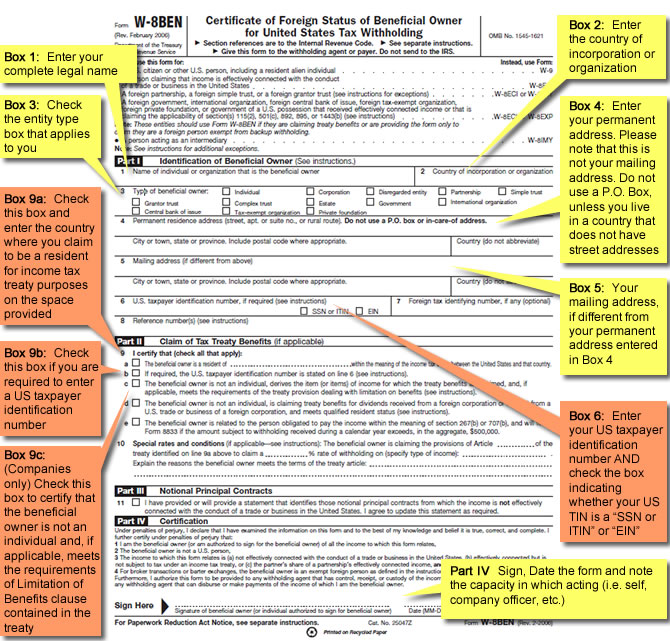

Please begin the process immediately, since we will be unable to process your royalty payments in excess of $600US pre calendar year until we receive the properly completed W-9 form. Non-US Resident Contributors As a U.S. Corporation, Clipcentric, Inc. is required to deduct 30% withholding tax from royalties paid to individuals and companies who are not US citizens or US tax residents. This 30% withholding tax rate may be reduced or eliminated if you are resident of a country that has entered into a tax treaty with the United States and you provide Clipcentric with a properly completed treaty claim. Form W-8BEN The US Internal Revenue Service (IRS) requires us to obtain a W-8BEN from each non-US contributor. The Form W-8BEN has been specifically designed for the purposes of:

You may download form W-8BEN and instructions here, or by visiting http://irs.gov. Guidelines for filling out form W-8BEN are provided below. If you are not claiming any withholding exemptions, Please fill out all sections highlighted in YELLOW. If you will be claiming treaty-based withholding exepmtions, you must ALSO fill out the sections highlighted in ORANGE. It is not required that you fill in any other fields. Once you have completed your W-8BEN, send with an original signature (i.e. not a copy) to:

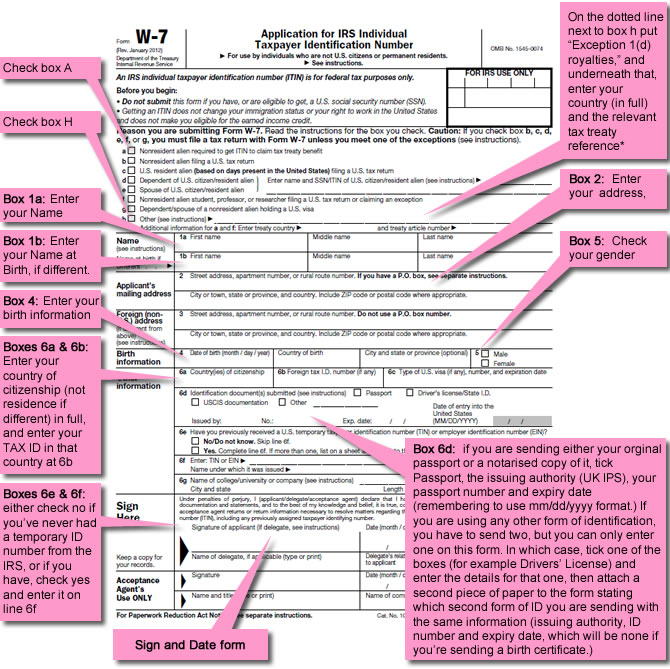

If you want to claim a withholding exeption, but you do not have a US Taxpayer Identification Number, you will need to apply for one. Individuals should apply using IRS form W-7, available here, or by visiting http://irs.gov. Entities (companies, organizations) should apply using IRS form SS-4, available here, or by visiting http://irs.gov. The process of applying for your TIN is more complicated and time consuming than any of the other contributor tax form requirements. The steps are described below: Form W-7 Individuals must file a completed form W-7 with the US Internal Revenue Service to apply for a Tax Identification Number. If you already have a TIN from doing business with another US stock media company, or for other reasons, you do not need to apply again. Simply use this number on your W-8BEN. If you are not claiming any withholding exeptions, you also do not need this number. Simply fill out the W-8BEN as described above. Note that as part of the TIN application process, you will be required to submit proof of identification, as well as a signed letter from Clipcentric on official letterhead, showing your name and evidencing that an ITIN is required to make distributions to you during the current tax year that are subject to IRS information reporting or federal tax withholding. In order for Clipcentric to provide you with this letter, you must have accrued at least $25US in royalties from your contributed assets. Once you have reached this threshold, simply email us at contributors@clipcentic.com and request that we mail you this letter.

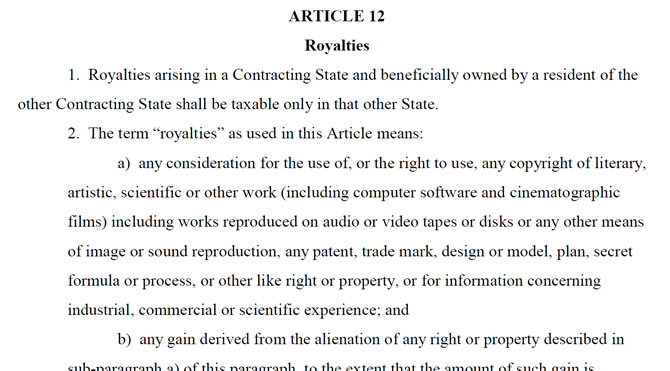

* For many countries, information on your specific tax treaty reference can be found in the Clipcentic Tax Treaty Summary. If your country of residence is not listed here, you may find it by examining the tax treaty between your county and the United States. A complete list of these tax treaties is available on the IRS website at http://www.irs.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties---A-to-Z. Find the link to your country, and then check the treaty's table of contents for the section that deals with royalties. The article number for that section is the treaty article number. For example, for the United Kingdom, one would visit the given IRS website, click on "United Kingdom" to find the most recent US/UK Income Tax Treaty document, and then search for the Article and section that defines the term "Royalties", as shown below. This is then your tax treaty reference... in this example 12 (2a).

Once your application and supporting documents are complete and assembled, mail to the US Internal Revenue Service at:

Unless delivering by a private delivery service, in which case mail to:

Please note that it can take 6-8 weeks for your to receive your Tax Identification Number form the IRS, so you should start this process as soon as possible. If Clipcentric is sponsoring your application, you should start the process as soon as you have accrued a balance of $25.00US in your contributor account. |